Follow These Steps to Become a Forex Trader

Content

Factors like interest rates, trade flows, tourism, economic strength, and geopolitical risk affect the supply and demand for currencies, creating daily volatility in the forex markets. This creates opportunities to profit from changes that may increase or reduce one currency’s value compared to another. A forecast that one currency will weaken is essentially the same as assuming that the other currency in the pair will strengthen.

There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. This number might sound a little high for beginners, but this will allow you to trade with a bit of a buffer in case of losses. You’re not looking to risk the entire amount but rather just have a higher cushion so that you’re not forced out of a trade, which can happen with smaller balances. Many Forex brokerage firms allow you to begin with $100 and learn how to trade. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Even with these alerts set, it’s still important to keep up to date with the latest news and political events that could move the forex market.

What is Forex Trading?

Okay, so the journey to becoming a successful Forex trader starts by finding the right broker. Unlike crypto, you definitely need a broker to set up a trade, and it’s actually very easy to find one. Most of the good brokerages are in the United States and Western Europe.

If you’ve decided to take a stab at forex trading, the good news is that access to the currency markets has never been easier. A wide range of online brokerage platforms offer everything from spot trading to futures and CFDs. Once you’re ready to move on to live trading, we’ve also got a great range of trading accounts and online trading platforms to suit you. Central Bank and Government PolicyCentral banks determine monetary policy, which means they control things like money supply and interest rates. The tools and policy types used will ultimately affect the supply and demand of their currencies.

That’s a really great number, and the more capital you put into it, and the more trades you do, the more you’ll earn. I guess the old expression about having to spend money to make money is as true as ever. Some of the money you need to spend is the capital you put up, but there are other costs. You should be ready to invest in your learning — buy books, courses, maybe even sign up for a few actual classes. Cloudzy provides high-performance Forex VPS solutions located at the hubs of global finance for very affordable rates.

These traders don’t necessarily intend to take physical possession of the currencies themselves; they may simply be speculating about or hedging against future exchange rate fluctuations. One of the most common reasons many people tend to leave Forex trading within a month is that they invest a lot of money in their trading right from day one. Of course, you don’t know anything about anything then, and making mistakes is a given.

World-leading FX trading platforms

Forex is short for foreign exchange – the transaction of changing one currency into another currency. This process can be performed for a variety of reasons including commercial, tourism and to enable international trade. The base currency is the reference element for the exchange rate of the currency pair. So “forex trading” can be defined as the process of speculating on currency prices to try and make a profit. As a forex trader, you are speculating on whether one currency will rise or fall in price against another currency.

You also have the chance to get used to the broker’s trading platform technology. The amount of money you can make from forex trading will depend on several factors, including your trading strategy, risk management plan, market knowledge, and financial goals. Some traders aim for consistent, modest returns, while others aim for larger, more speculative profits. While individual investors are not able to participate in spot FX trading, there are forex trading platforms that give retail traders access to the secondary OTC market.

Start learning

This will give you enough buying power to trade a standard lot, which is 100,000 units of currency. If you can afford to trade a larger position, you may be able to trade a mini lot (10,000 units) or even a micro lot (1,000 units). However, it is important to remember that the Forex market is highly leveraged, which means that even a small movement in the markets can have a significant impact on your account balance. As such, it is important to use risk management tools such as stop-loss orders to protect your account from excessive losses. With proper risk management in place, you can trade Forex with a relatively small amount of capital.

If you miss one opportunity, remember that there is another one just around the corner. Although many entities trading foreign currencies via the forex market are banks, governments and high-volume brokers, there’s space at the table for individual investors as well. Companies doing business in foreign countries are at risk due to fluctuations in currency values when they buy or sell goods and services outside of their domestic market. Foreign exchange markets provide a way to hedge currency risk by fixing a rate at which the transaction will be completed.

Therefore, events like economic instability in the form of a payment default or imbalance in trading relationships with another currency can result in significant volatility. The spot market is the largest of all three markets because it is the “underlying” asset on which forwards and futures markets are based. When people talk about the forex market, they are usually referring to the spot market. The FX market gives you the opportunity to find trading opportunities around the clock on your schedule.

Forex trading examples

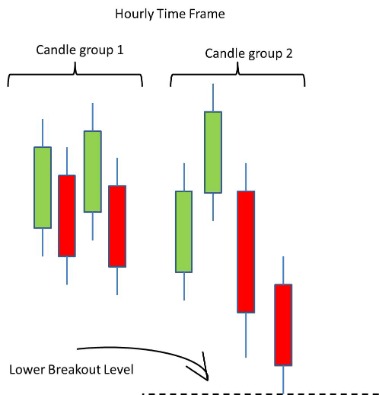

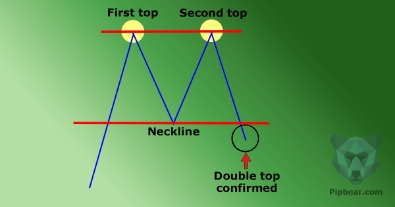

And one of the best ways to learn this is through price action; the technique that the majority of professional traders use. Once you have learned how to read the charts, you will know why the market is going up, down or sideways and then will you recognize which strategy to put into play in that direction. Experienced traders have typically learned how to analyze the forex market to make better trading decisions.

- This makes it the world’s leading ecosystem of FX trading platforms in the world.

- On the forex market, trades in currencies are often worth millions, so small bid-ask price differences (i.e. several pips) can soon add up to a significant profit.

- Most online forex brokers accept a number of ways to fund an account, including bank wire transfers, debit card payments or transfers from electronic payment providers like Skrill or PayPal.

- This migration will, for instance, accelerate the processing of electronic orders to sub-millisecond latencies.

- Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

- There are seven major currency pairs traded in the forex market, all of which include the US Dollar in the pair.

Eleven years later, Reuters launched another game-changer with the trading platform Matching. “When banks did price discovery, they would need to call everybody else to see if there was interest,” says Joris. This ecosystem constitutes a market that, in the past three decades, evolved to be one of the largest industries in the https://g-markets.net/helpful-articles/learn-the-ascending-triangle-pattern-how-to-trade/ world, with daily trades totalling US$6.6 trillion. Behind that evolution stands Refinitiv, a company that pioneered many of its innovative breakthroughs, and is now a part of LSEG. This means sticking to your trading plan, avoiding impulsive trades, and being willing to wait for the right opportunities to present themselves.

Forex market trading hours

An economic calendar is a tool that displays upcoming economic events and their potential impact on the forex market. Forex traders use economic calendars to stay informed about key events and to anticipate market movements. Forex trading can be a very lucrative job, with payouts that can change your life around. Let’s take a look at what you can expect to pull in — who knows, you may decide you don’t need to learn how to become a Forex trader after all.

For example, they may put up $50 for every $1 you put up for trading, meaning you will only need to use $10 from your funds to trade $500 in currency. In addition to forwards and futures, options contracts are traded on specific currency pairs. Forex options give holders the right, but not the obligation, to enter into a forex trade at a future date. Currencies are traded worldwide in the major financial centers of Frankfurt, Hong Kong, London, New York, Paris, Singapore, Sydney, Tokyo, and Zurich—across almost every time zone.

Experienced forex traders may not need guidance, but these five steps are primarily meant to assist with how to start forex trading in Kenya for beginners. Even after preparation and gathering information about the world of forex trading, accept that you are at the beginning of a long journey. Patience is a winning attribute, especially when putting real money on the line in the world’s largest financial market, known for behaving erratically at times.

Diversifying your portfolio is a great way to manage risk and reduce the impact of any single trade. This can be done by trading multiple currency pairs or investing in other financial markets, such as stocks or commodities. Swing trading involves holding positions for several days to several weeks to profit from larger price movements. Swing traders use technical analysis to identify potential trade setups, and they may also consider fundamental factors, such as economic news and events. It offers advanced charting, market analysis, and trading automation capabilities, as well as access to a wide range of financial markets.